Evaluating Your Malpractice Insurance Provider

Some of our members may have recently received a letter notifying them that their malpractice carrier is changing, and another company will be underwriting their insurance. This is something you may be used to seeing from your mortgage company, and it usually doesn’t impact your day-to-day activities much—but if your professional liability insurance provider is changing, you must act.

Professional liability insurance protects you and your industry. It’s one of the most important decisions a dentist can make. Although the number of malpractice claims each year is decreasing, settlement amounts are at record highs, and you must make sure your carrier can adequately protect you.

Sometimes, your provider can be chosen for you. Periodically, insurance agents review their carrier relationships, and may decide to switch carriers for reasons that aren’t always in your best interest. Although your coverage might not appear to change much, it’s vital that you vet the new company to ensure that you’re adequately protected.

What To Look For

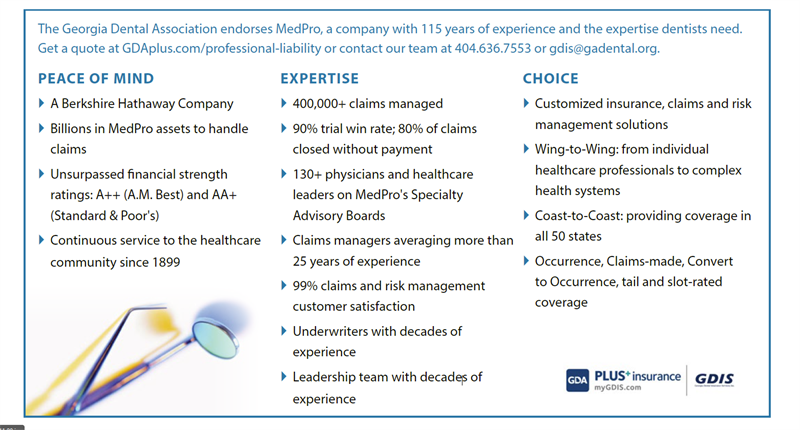

- Financial Strength: It’s more expensive to take a case to trial than to settle. Some claims can take years, and financial strength means your provider has the ability to see a case through its duration, even when it can cost millions in attorney fees.

- Choice: You must make sure that you have a say in whether a claim is settled,

or whether your insurance provider will fight for you and take the case to court.

- Experience: A high trial win rate indicates that your provider can help protect your reputation. If a company is untested, you may not be as secure.

- Expertise: Companies with boards made up of physicians and healthcare leaders mean that your provider has knowledge of the details of medical malpractice claims and expert advice on how cases should be handled. The bottom line is that you must make sure a carrier is in business to protect you and not themselves.

At GDA, you have a team of experienced insurance agents who can help you make the decision that’s right for you. We suggest that if you do receive a letter informing you of a carrier change, reach out to us! Our agents are a valuable member benefit—we can take a look at what your policy offers, and help you understand your new coverage and carrier.

Feel free to contact your

GDA Plus+ Insurance/GDIS team—let us give you the tools to make the best decision for your career and profession.